Do Hybrid Cars Qualify For Tax Credit

Starting in 2011 only the hybrids that use plug-in electrical outlets to charge their batteries will get credits. For some models the credit amount can fall well below 7500.

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

The vehicle must be a plug-in electric car.

Do hybrid cars qualify for tax credit. The hybrid vehicle is one of five types of alternative motor vehicles identified by the Internal Revenue Service for tax credits. Neem eenvoudig online of telefonisch contact op met een van onze dealers. For example US.

As in you may qualify for up to 7500 in federal tax credit for your electric vehicle. A fully electric vehicle has more battery capacity than a hybrid model so hybrid vehicles do not receive the full 7500 incentive. Models like the Toyota Prius and the Hyundai Sonata Hybrid dont have batteries that can be charged from an external source so theyre no longer relevant for tax credit purposes.

3 To qualify the following criteria must be met. There are several rules and requirements for a vehicle to qualify for the federal tax credit. Hybrids and clean-diesel cars used to qualify for tax credits but these were discontinued in December 2010.

Vehicle Eligibility Criteria. My locality happens to offer a cheaper excise tax 2 vs 54if 20 ballpark estimates are to be believed for any vehicle with 40mpg city or higher but thats about it. Its an all-electric or plug-in hybrid vehicle It has four wheels You didnt lease the vehicle.

A fully electric vehicle which does not use gasoline will likely qualify for the full 7500. The federal EV tax credit is based on the capacity of the vehicles battery back. The vehicle in question weighs less than 14000 pounds.

At first glance this credit may sound like a simple flat rate but that is unfortunately not the case. Once a car manufacturer sells 200000 all-electric and plug-in hybrid vehicles the tax incentive begins to slowly phase out for its vehicles. A minimum of 2500 from the EV tax credit -- that includes a plug-in hybrid.

December 1 2020 - To get the federal EV tax credit you have to buy a new and eligible electric car. News and World Report and Edmunds report that you can receive a 4502 tax credit if you purchase the plug-in Toyota Prius Prime hybrid hatchback. They are as follows.

Think the tax credits are only for EVs and Plug-Ins. Qualified Plug-In Electric Drive Motor Vehicle Tax Credit for Hybrids This credit can be claimed for a qualified plug-in hybrid vehicle that was put into service in the US. Do hybrid cars qualify for the tax credit.

However if you are driving a plug-in hybrid electric vehicle which still uses some gasoline then you may not qualify for the full 7500. The vehicle must come from a manufacturer and be purchased new. In addition cars do not stay eligible forever.

Additionally most EVs and plug-in hybrids would qualify only for the base 7500 tax creditsame as available todaybecause the measure reserves the first 2500 bump to. This tax credit ranges from 2500 to 7500 as of 2021. Here are the currently available eligible vehicles.

Ontdek nu de Citron C5 Aircross SUV Hybrid. Advertentie D SUV in e-comfort klasse. Beginning in the second calendar quarter after a manufacturer hits that sales figure the tax credit drops to 50 percent of its value from 7500 to.

Are There Any State Programs I Can Take Advantage Of. For example the Toyota Prius Prime a plug-in hybrid hatchback only qualifies for a 4502 tax credit. The qualified hybrid vehicle tax credit which originally allowed taxpayers to deduct up to 7500 is available to taxpayers who purchase a new qualifying hybrid vehicle.

The vehicle has a simple set of guidelines to meet. Do EV tax credits count for used. Most gas-electric hybrid cars qualified for federal income tax credits for a few years but as 2010 ran down so did the credits.

It cannot be a home-built unit or a kit car. Them out after a particular automakers sells over 200000 qualifying vehicles.

Pin On Best Of A Girls Guide To Cars

Diagram Of Electric Car Electric Vehicle Charging Station Car Charging Stations Electric Car Charging

What Is A Hybrid Car Tax Credit

Electric Vehicle Tax Credits What You Need To Know Edmunds

The 33 745 Plug In Energi Qualifies For 3 750 Federal Tax Credit Plus An Additional 1 500 Tax Credit For California Residents Tax Credits Federal Taxes Tax

Electric Vehicle Tax Credits What You Need To Know Edmunds

The C Max Hybrid Pictured Augments A 2 0 Liter Four Cylinder Gasoline Engine With An Electric Motor Generator And Ford C Max Hybrid Fuel Efficient Cars Ford

An Electrical Component That Many Not Have Been Installed Properly And Could Lead To The Risk Of A Fire Prompted Hyundai On Tuesday To Recall About 10 600 Hybri

Is An Electrical Automobile Best For You With The Decrease Price Of Operation Nearly No Upkeep And Tax Credit That May Sl Electric Car Hybrid Car Electricity

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

15 Best Hybrid And Electric Cars For The Money In 2020 U S News World Report

C Max Hybrid Starting At 24 170 00 Ford C Max Hybrid Hybrid Car Ford

Honda Hybrid Comparison 2021 Honda Hybrids Ev Buying Guide

What Is A Hybrid Electric Vehicle Forbes Wheels

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Electric Vehicle Tax Credits What You Need To Know Edmunds Com Bmw I3 Hybrid Car Bmw I3 Electric

Pros And Cons Of Hybrid Cars What You Need To Know Energysage

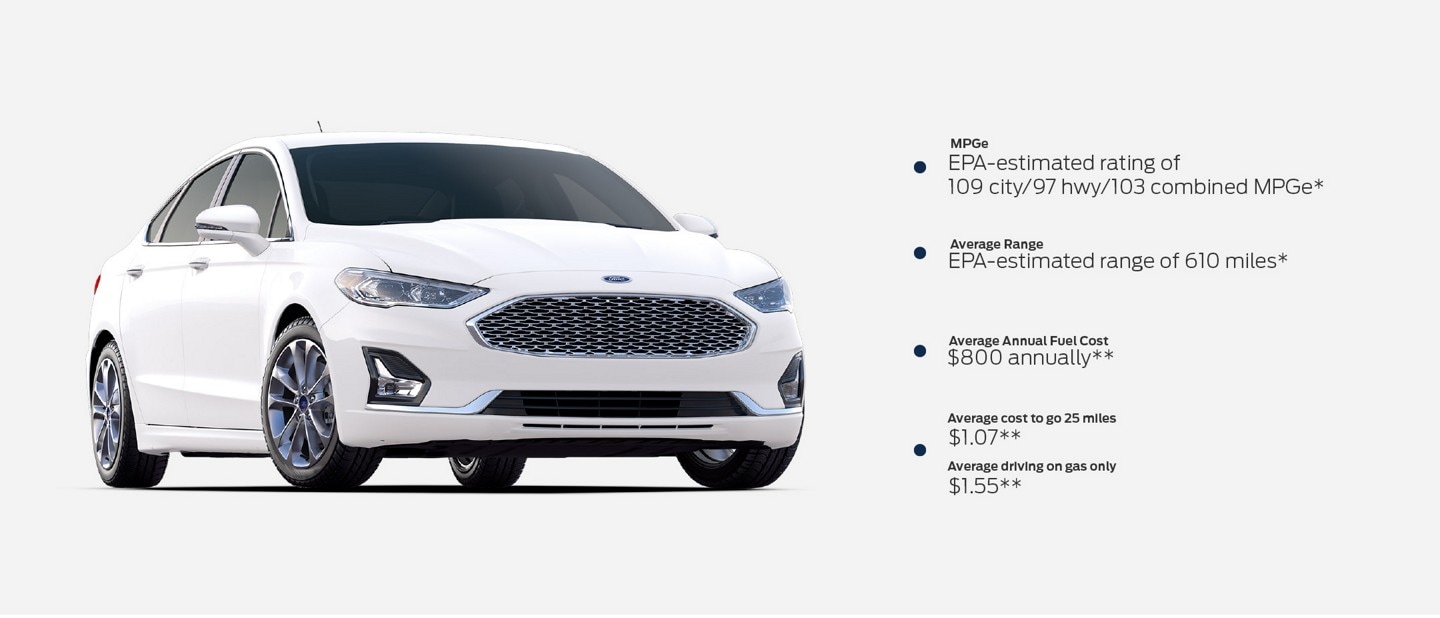

Ford Plug In Hybrid Electric Vehicles Adapt On The Go In A Phev

Post a Comment for "Do Hybrid Cars Qualify For Tax Credit"